KONE 2015 | SUSTAINABILITY REPORT

KEY FIgURES 2015

6

Key financial figures

2014

2015 change, %

Orders received

MEUR

6,812.6

7,958.9

16.8%

Order book

MEUR

6,952.5

8,209.5

18.1%

Sales

MEUR

7,334.5

8,647.3

17.9%

Operating income

MEUR

1,035.7

1,241.5

19.9%

Operating income

%

14.1

14.4

Cash flow from operations

(before financing items and taxes)

MEUR

1,345.4

1,473.7

Net income

MEUR

773.9

1,053.1

Basic earnings per share

EUR

1.47

2.01

Interest-bearing net debt

MEUR

-911.8

-1,512.6

Total equity/total assets

%

43.6

45.4

Gearing

%

-44.2

-58.7

R&D expenditure

MEUR

103.1

121.7

KEY FIgURES 2015

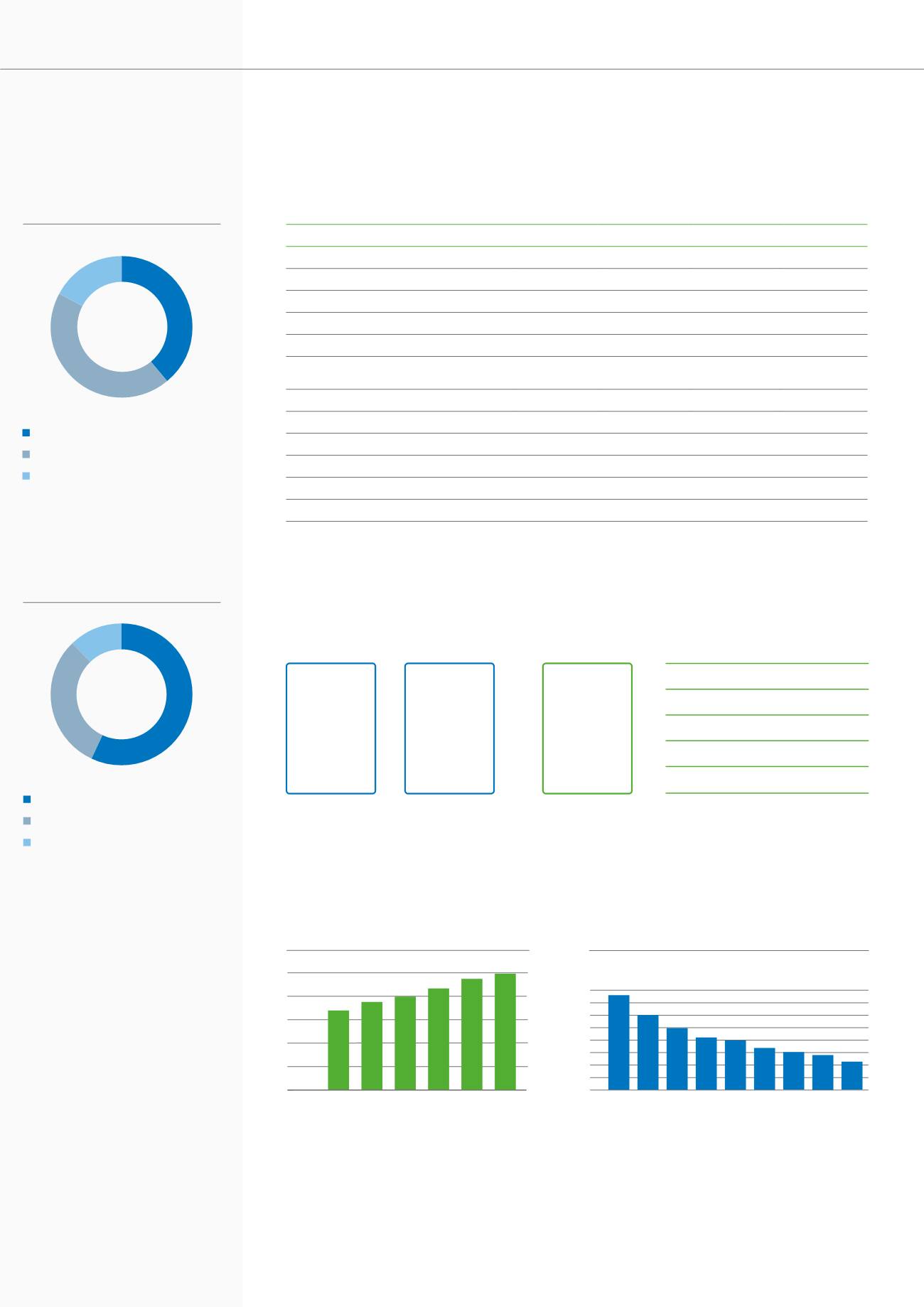

Sales by business, 2015

57%

31%

12%

New equipment 57% (55%)

Maintenance 31% (32%)

Modernization 12% (13%)

(2014 figures in brackets)

Number of employees, end of year

50,000

40,000

30,000

20,000

10,000

0

2013

2012

2011

2010

Sales by market, 2015

39%

44%

17%

EMEA 39% (44%)

Asia-Pacific 44% (41%)

Americas 17% (15%)

(2014 figures in brackets)

2014

Customers

8,647

(7,334)

MEUR

Suppliers

4,960

(4,198)

MEUR

Added value

3,687

(3,136)

MEUR

- =

Stakeholders

KONE’s economic impacts in 2015

Employees

1,825

(1,578) MEUR

Creditors

-122

(-19) MEUR

Public sector

932

(765) MEUR

Shareholders

718

(616) MEUR

Economic value

retained in the company

334

(196) MEUR

(2014 figures in brackets)

Industrial Injury Frequency Rate

development among KONE employees

KONE tracks the number of lost time injuries of one day or more,

per million hours worked, as a key performance indicator. The

IIFR covers KONE’s own employees.

2007 2008 2009 2010 2011 2012 2013

8

7

6

5

4

3

2

1

0

2014 2015

2015

33,755

37,542 39,851

43,298

47,064 49,734

7.5

6.0

5.2

4.3 4.1

3.4 3.0 2.8

2.3