KONE 2016 | SUSTAINABILITY REPORT

ECONOMIC RESPONSIBILITY

40

Read more

about our economic performance

at

www.kone.com/investors.global processes and guidelines, but our

operations are at the same time very local.

In our subsidiaries, management and field

personnel are predominantly local. KONE had

over 52,000 employees in over 60 countries

at the end of 2016. In 2016, the largest KONE

countries by the number of employees were

China, the United States and India. Read more

about our people on p. 34-37.

Shareholders

KONE’s strong financial performance

has enabled increasing dividends to our

shareholders. In total, KONE distributed

approximately EUR 795 million in dividends

for the financial year 2016. Also with a longer-

term perspective, our track record on dividend

distribution has been sustainable. During the

last ten years the, dividends have grown by

20% per year on average. KONE had over

57,000 shareholders at the end of December

2016. (Dec. 2015: over 56,000 shareholders)

Ensuring added value in the future

KONE has three long-term financial targets:

growing faster than the market, achieving an

EBIT margin of 16%, and improving working

capital rotation. We have achieved two of

these three targets: KONE has grown faster

than the market in recent years, and we

have improved our working capital rotation

at the same time. For the 16% EBIT margin,

no target date has been set. With our life-

cycle business model, the short-term focus

is on growing absolute EBIT while achieving

improved relative profitability over time

with growth and productivity gains. KONE’s

philosophy is to continuously develop the

business with a long-term outlook. We are

focused on maintaining our challenger

attitude and we are constantly developing our

competitiveness in order to strengthen our

position as one of the global leaders in the

elevator and escalator industry.

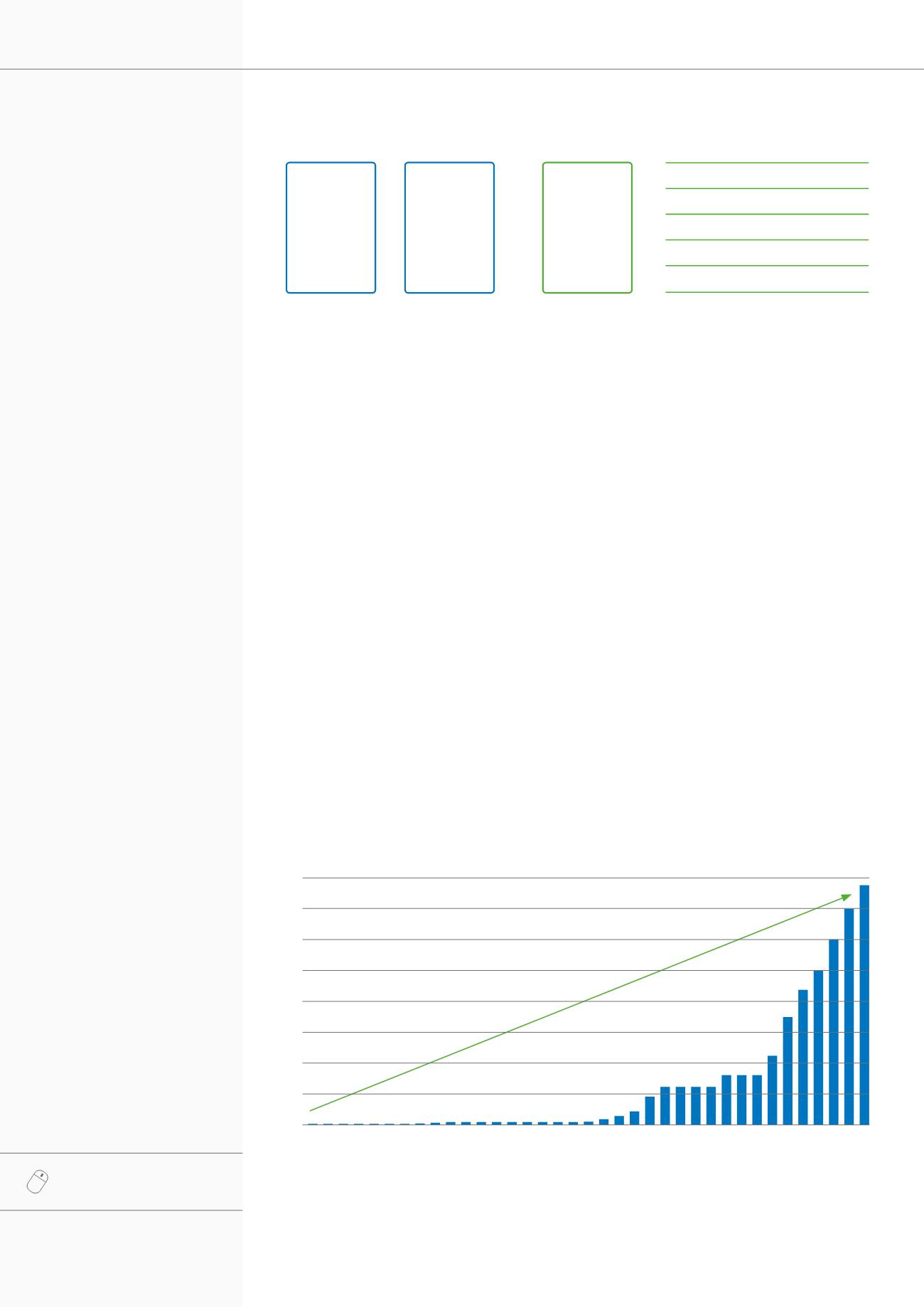

1)

Note: Includes the basic dividend. Adjusted for share splits in 1999 (1:3), 2002 (1:3), 2005 (1:2), 2008 (1:2) and 2013 (1:2).

1 EUR= 5.9 FIM; not adjusted to constant exchange rate. Additional extraordinary dividends: for 2009, a double dividend was

paid; for 2011, an extraordinary dividend of EUR 0.75 was paid and for 2012, an extraordinary dividend of EUR 0.65 was paid.

2)

Compound annual growth rate

KONE’s largest individual

shareholder is Antti Herlin,

Chairman of KONE’s Board of

Directors, who controls over 20%

of the share capital and over 60%

of votes.

For KONE’s domestically registered

major shareholders, see monthly

updated list on our website.

Split-adjusted dividend per class B share, EUR, 1980–2016

1

1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

CAGR

2

1980–2016

+15%

-80 -81 -82 -83 -84 -85 -86 -87 -88 -89 -90 -91 -92 -93 -94 -95 -96 -97 -98 -99 -00 -01 -02 -03 -04 -05 -06 -07 -08 -09 -10 -11 -12 -13 -14 -15 -16

Customers

8,784

(8,647)

MEUR

Suppliers

4,857

(4,960)

MEUR

Added value

3,927

(3,687)

MEUR

- =

Stakeholders

KONE’s economic impacts in 2016

Employees

1,962

(1,825) MEUR

Creditors

-36

(-122) MEUR

Public sector

979

(932) MEUR

Shareholders

795

(718) MEUR

Economic value

retained in the company

226

(334 MEUR

(2015 figures in brackets)

LONG-TERM FINANCIAL TARGETS

GROWTH:

Faster than the market

PROFITABILITY:

16% EBIT margin

CASH FLOW:

Improved working capital

rotation

Our positive financial

performance in recent

years has enabled us to

generate stakeholder

value for our customers

and suppliers,

local communities,

employees and

shareholders alike.