KONE 2013 | CORPOR ATE RESPONSIBILIT Y REPORT

KEY FIGURES 2013

6

Key financial figures

2012

2013 change, %

Orders received

MEUR

5,496.2

6,151.0

11.9%

Order book

MEUR

5,050.1

5,587.5

10.6%

Sales

MEUR

6,276.8

6,932.6

10.4%

Operating income

MEUR

828.7

1)

953.4

15.1%

Operating income

% 13.2

1)

13.8

Cash flow from operations

(before financing items and taxes)

MEUR

1,070.8

1,213.1

Net income

MEUR

611.0

713.1

Basic earnings per share

EUR

1.17

1.37

Interest-bearing net debt

MEUR

-574.0

-622.0

Total equity/total assets

%

47.1

43.7

Gearing

%

-31.3

-36.1

R&D expenditure

MEUR

86.1

96.5

1)

Excluding a MEUR 37.3 one-time cost related to the support function development and cost adjustment programs.

Key figures 2013

8

7

6

5

4

3

2

1

0

2007 2008 2009 2010 2011 2012 2013

IIFR development*

*Industrial Injury Frequency Rate. KONE tracks the

number of lost time injuries of one day or more, per

million hours worked, as a key performance indicator.

The IIFR covers KONE’s own employees.

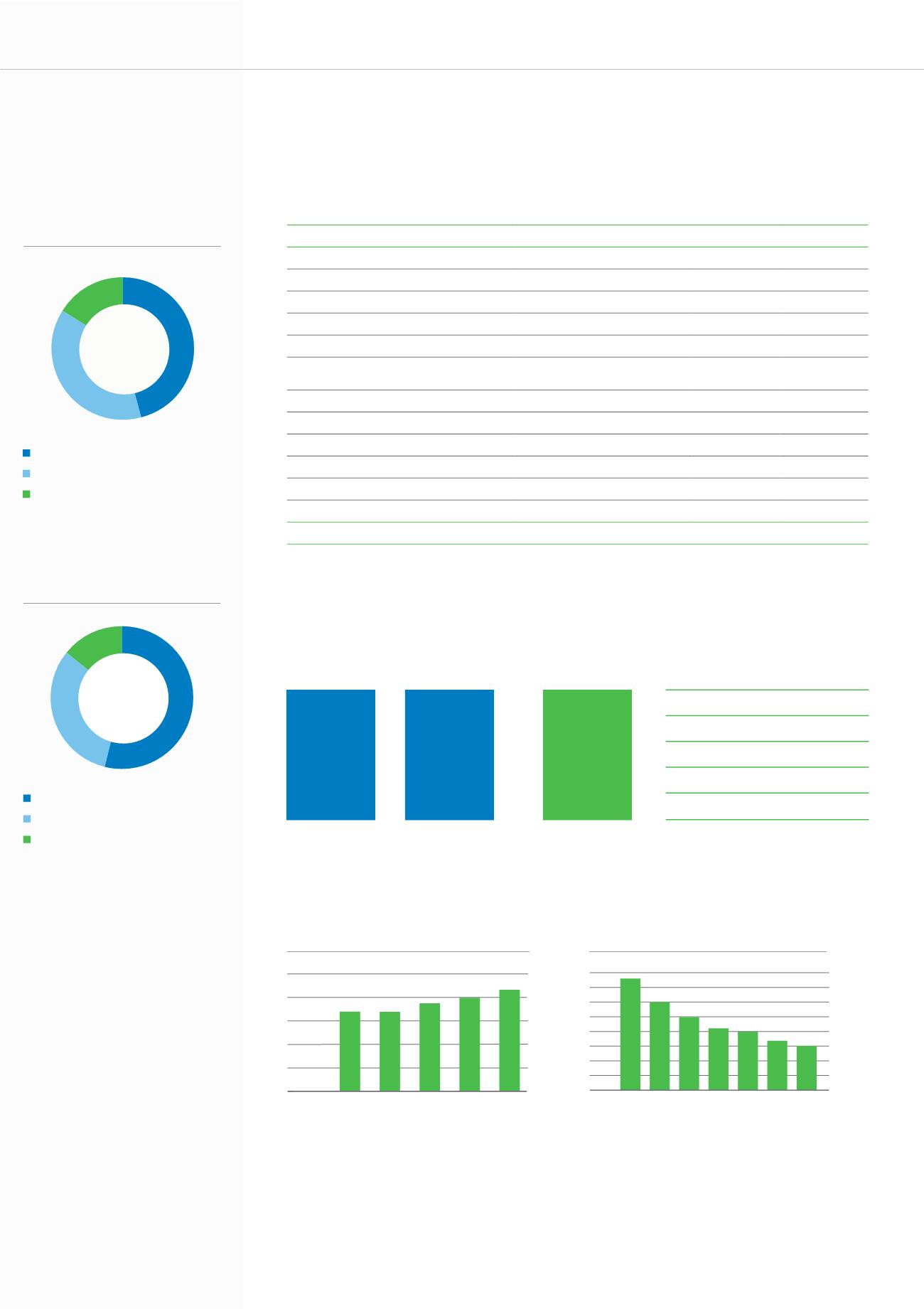

Sales by market, 2013

46%

38%

16%

EMEA 46% (49%)

Asia-Pacific 38% (35%)

Americas 16% (16%)

(2012 figures in brackets)

Sales by business, 2013

54%

32%

14%

New equipment 54% (50%)

Maintenance 32% (34%)

Modernization 14% (16%)

(2012 figures in brackets)

2009

2010 2011

2012 2013

Number of employees, end of year

50 000

40 000

30 000

20 000

10 000

0

Customers

6,933

(6,277)

MEUR

Suppliers

3,995

(3,610)

MEUR

Added value

2,938

(2,667)

MEUR

- =

Stakeholders

KONE’s economic impacts in 2013

Employees

1,473

(1,375) MEUR

Creditors

-6

(-8) MEUR

Public sector

758

(693) MEUR

Shareholders

512

(781) MEUR*

Economic value

retained in the company

201

(-174) MEUR

(2012 figures in brackets)

*Dividends paid for the financial year. The figure for the financial year 2012 includes a special dividend.